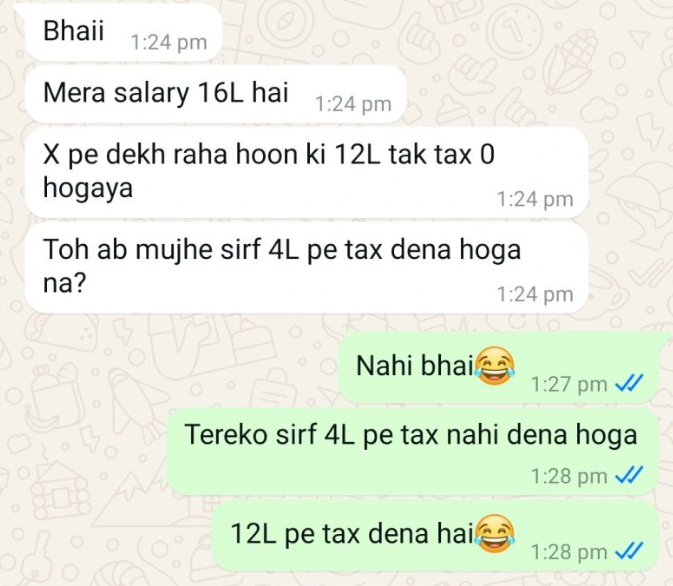

The 0 tax on income upto Rs 12 lakh is applicable only when income is below 12 lakh. (12.75L if we consider standard deduction of 75K as well)

However if income is more than 12.75 lakh, you will have to pay full tax from 4 lakh and above.

0-4 lakh – 0 tax

4-8 lakh – 5% tax

8-12 lakh – 10% tax

12-16 lakh – 15% tax

16-20 lakh – 20% tax

20-24 lakh – 25%

Abv 24 lakh – 30%

The basic exemption limit (i.e. the income which is exempt from tax) is increased to 4L and not 12L

This is applicable only in case of New Tax Regime

Also it does not include special rates of income. STCG and LTCG will be taxed accordingly