Contribution margin means the sale price minus the variable cost incurred on the product. It is the ability of the firm or company to cover its variable cost with the revenue. The remaining amount i.e. the contribution covers fixed cost or is the profit earned by the firm or company.

The calculation of contribution margin is of good significance for any company. It not only helps the business to evaluate its profitability, but it also helps to know the margins of different product lines. By determining the contribution margin of different products, the business knows which product gives more margins and which product line is underperforming. Based on the analysis, the business can frame strategies and take necessary actions. By compiling the data, the company can increase the sales of the products that yield a higher margin

Formula of Contribution Margin

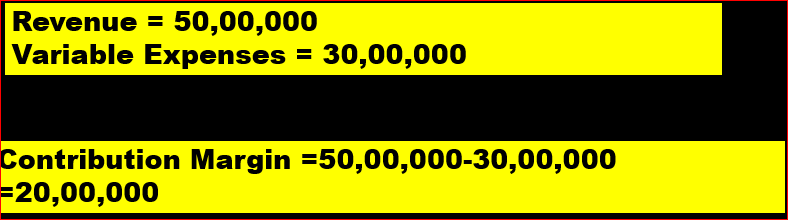

Contribution Margin = Sale – Variable Cost

Sales Revenue = Total sale

Variable Expenses = Total Expenses – Fixed Expenses

Example of Contribution Margin Calculation