Debt Service Coverage Ratio (DSCR) is a coverage ratios, calculated for known the cash profit availability to repay the principal and interest. Essentially, DSCR is calculated when a company takes a loan from bank and other financial institutions. This ratio suggests the capability of cash profits to meet the repayment of the financial loan including interest. DSCR is very important from the viewpoint of the financing authority as it indicates the repaying capability of the entity taking a loan.

Formula of Debt Service Coverage Ratio (DSCR)

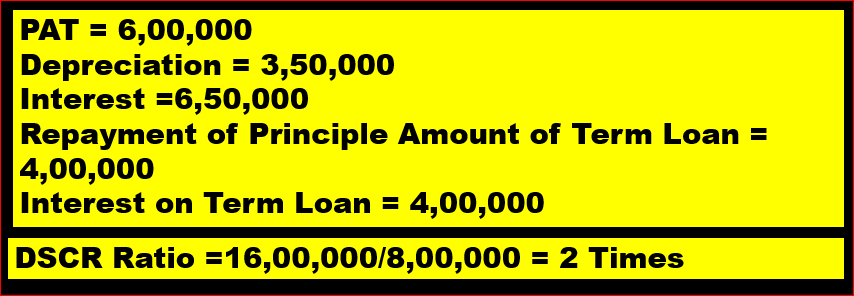

DSCR Ratio = (Profit after Tax+ Depreciation+ Interest on Term Loan)/Interest on Term Loan+ Principle amount of Term Loan

Example of how to calculate DSCR