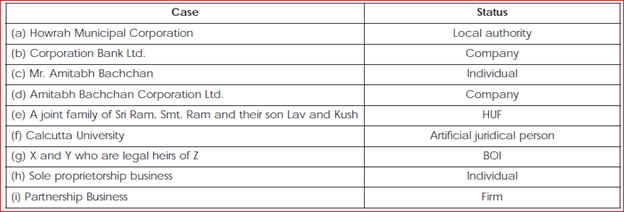

The person includes the following:

- an Individual.

- a Hindu Undivided Family (HUF).

- a Company.

- a Firm.

- an Association of Persons (AOP) or a Body of Individuals (BOI), whether incorporated or not.

- a Local authority; &

- every artificial juridical person not falling within any of the preceding categories.

Now we are discussing in detail all above heads.

Individual

Individual means a natural human being whether male or female, minor or major.

Hindu Undivided Family (HUF)

A Hindu Undivided Family (on which Hindu law applies) consists of all persons lineally descended from a common ancestor & includes their wives & unmarried daughters.

Company [Sec. 2(17)]

Company means an artificial person registered under Indian Companies Act 1956 or any other law.

Firm

As per sec. 4 of Indian Partnership Act, 1932, partnership means “relationship between persons who have agreed to share profits of the business carried on by all or any one of them acting for all”.

Persons, who enter such business, are individually known as partners and such business is known as a Firm. A firm is, though not having a separate legal entity, but has separate entity in the eyes of Income-tax Act

Association of Persons (AOP) or Body of Individuals (BOI)

An AOP means a group of persons (whether individuals, HUF, companies, firms, etc.) who join for common purpose(s). Every combination of person cannot be termed as AOP. It is only when they associate themselves in an income-producing activity then they become AOP. Whereas, BOI means a group of individuals (individual only) who join together for common purpose(s) whether or not to earn income.

Co-heirs, co-donees, etc joining together for a common purpose or action would be chargeable as an AOP or BOI. In case of income of AOP, the AOP alone shall be taxed and the members of the AOP cannot be taxed individually in respect of the income of the AOP

Difference between AOP and BOI

■ In case of BOI, only individuals can be the members, whereas in case of AOP, any person can be its member i.e. entities like Company, Firm etc. can be the member of AOP but not of BOI.

■ In case of an AOP, members voluntarily get together with a common will for a common intention or purpose, whereas in case of BOI, such common will may or may not be present.

Local Authority

As per Sec. 3(31) of the General Clause Act, a local authority means a municipal committee, district board, body of Port Commissioners, Panchayat, Cantonment Board, or other authorities legally entitled to or entrusted by the Government with the control and management of a municipal or local fund.

Artificial Juridical Person

Artificial juridical person are entities –

● which are not natural person;

● has separate entity in the eyes of law;

● may not be directly sued in a court of law but they can be sued through person(s) managing them

E.g: Deities, Idols, University, Bar Council, etc.

Example: